No Hidden Fees

Transparent pricing with no unexpected charges.

Are you looking for a loan, mortgage, or lіnе оf credit? You are in the right place.

Seventh Avenue is a Fintech which was incorporated in 2017 and a registered financial services provider under the Ministry of Finance. Seventh Avenue leverages on technology to bridge the information asymmetry gap in order to effectively provide affordable and sustainable financial services across market segments.

CONTACT US* Checking your rate won't affect your credit score.

A structured and efficient approach to loan processing.

Comprehensive financial solutions tailored to your needs.

Ideal for an individual or entity that has been in operation for more than 6 months and is looking for working capital to scale up operations.

Idea for an individual in formal employment for more than 6 months whose entity has a sign MOU.

Ideal for an individual with a salary back or business loan that needs capital for business or home expenses.

Ideal for individual that do not have collateral who can guarantee each other if they default on the portfolio.

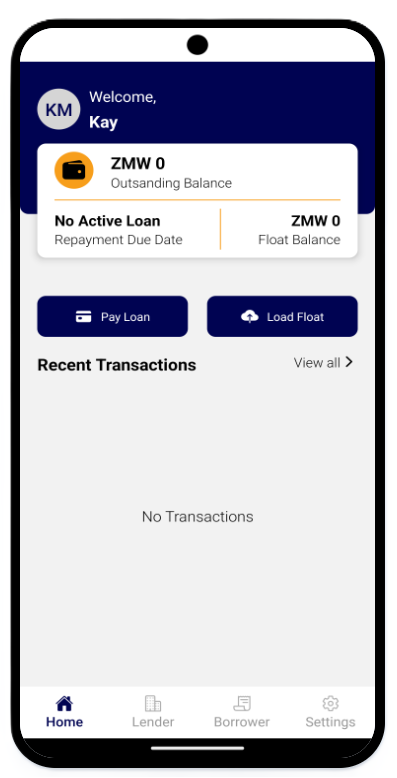

Our app empowers you to take control of your finances, offering quick and convenient access to microloans tailored to your needs.

Clear answers to your most common financial questions.

Stay informed with our latest updates, insights, and announcements.

2026. All Rights Reserved - Powered by innovEx Solutions Limted